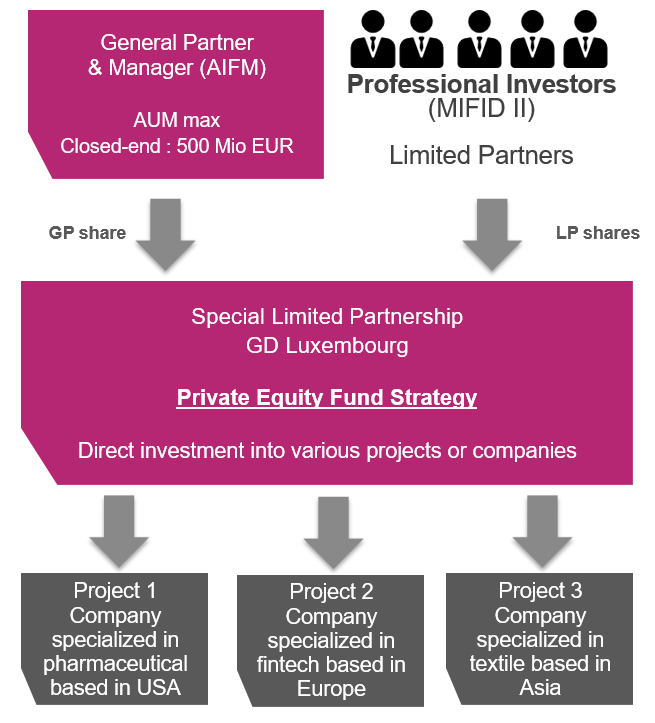

Private Equity Fund

Luxembourg is home to thousands of private equity vehicle and investment funds that invest in the economy, people and private equity deals around the world in different sectors of the industry, such as finance, infrastructure, IT, pharmaceutical, hospitality, asset management and the digital economy.

Investors, fund promoters, private equity firms, General Partners, managers and family offices that choose Luxembourg as a base for their private equity investments can select from a variety of different structures suited to their needs.

Among which are like SOPARFIs, SPFs, for unregulated corporate vehicles, SICAR, SIF & RAIF for regulated investment funds and Special Limited Partnerships which is particularly well-suited for the following Private Equity strategies.